Industry Purchasing Practices

How can manufacturers use TIWW's purchasing practices metric?

-

Download the guide here

-

How can manufacturers use TIWW's purchasing practices metric? - Download the guide here -

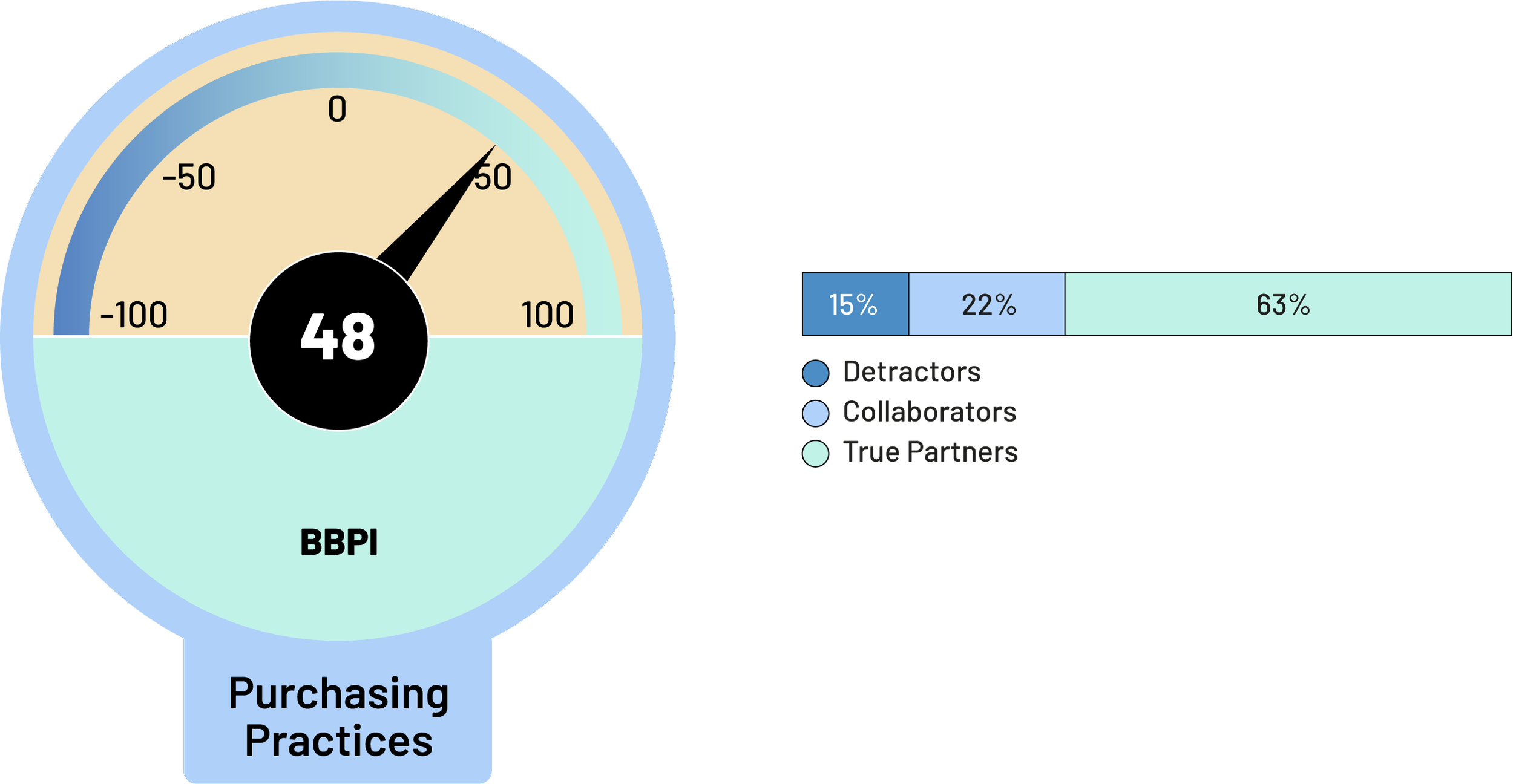

Purchasing Practices Industry Score

Of a potential range from -100pt to +100pt, The Industry We Want purchasing practices metric scores 48, compared to 40 in 2023 and 39 in 2022. Our purchasing practices metric uses data gathered through the Better Buying Partnership Index™ (BBPI); a brief annual survey available for all suppliers to rate their buyer’s purchasing practices. The survey, circulated in October and November 2023, received over 1000 responses from suppliers in the garment sector. Of those responses, 63% of behaviours were considered those of a true partner, 22% were the behaviours of a collaborator and 15% of behaviours were the behaviours of a detractor.

ETI and Fair Wear Scores

The 2024 scores of the two initiators of The Industry We Want, the Ethical Trading Initiative and Fair Wear Foundation, are devised by collecting all supplier responses pertaining to their member brands. Fair Wear scores 52 points, compared to 39 points in 2023 and 67 points in 2022. ETI scores 77 points, compared to 50 points in 2023 and 47 in 2022.

ETI and Fair Wear’s strongest performance lies in:

Absence of corruption and bribery;

Communication;

Improving working conditions in facilities in its supply chain.

Suppliers to both ETI and Fair Wear member brands reported that buyers could improve, amongst other things, more consistent and stable business practices to enhance the strength of their partnerships.

Equally to the 2023 and 2022 reports, all scores were generated thanks to the Better Buying Partnership Index™: a 12-point annual survey available for all suppliers to rate their buyer’s purchasing practices on a scale of 1 to 5. Scores of 5 indicate that the buyer is behaving as a true partner: a buyer who understands and embodies their role in creating mutually beneficial and sustainable partnerships. Scores of 4 indicate that the buyer is behaving as a collaborator: buyers who strive toward improved communications with their partners and increasing levels of collaboration, transparency and responsibility. Scores of 1 to 3 indicate that the buyer is behaving as a detractor: a buyer who demonstrates a lack of trust in and respect for their suppliers by limiting information-sharing and failing to make efficient use of time and resources.

The overall score is obtained by subtracting the percentage of the true partners by the percentage of detractors.

Our Approach

Many of the commitments made by both brands and factories can be achieved through the implementation of responsible purchasing practices. This approach provides the space and financing for improvements across the board particularly related to brand code of conducts. We invited manufacturers across the globe to participate in the most accessible industry-wide supplier feedback survey, to ensure we collect as much information from as wide a stakeholder base as possible. The more data we collect, the more robust this score will be and the more we will be able to measure and track change across the industry.

The survey was open between October 2 until November 17 2023. With each cycle, we aim to confirm the previous year’s benchmark and re-assert the findings that we see from the current year. We are working on expanding participation to establish this survey as a regular and consistent opportunity for suppliers to provide feedback on their commercial relationships, highlighting areas in which behaviours and practices have improved, as well as areas in need of sustained attention and improvement.

Attention towards implementing responsible purchasing practices and engaging in constructive sourcing dialogues has increased, especially among brands associated with MSIs like Fair Wear, the Ethical Trading Initiative (ETI), and the Sustainable Apparel Coalition (SAC), which has led to a rise in the purchasing practices score. The vast majority of suppliers (79.4%) are rating brands they consider preferred partners. This means that the results reflect industry best practice, rather than industry norm. Indeed, while the score offers valuable insights, it may not fully reflect the realities and challenges faced by suppliers, workers and the broader industry. Therefore, further cycles and more participation from suppliers will be necessary to draw more accurate conclusions.

Want to know more about the survey behind this metric? Watch the recap of the 2022 joint webinar with Better Buying™ explaining the BBPI in depth.

The Policy Changes We Want

Policies are being initiated alongside the proposal of mandatory due diligence legislation across the European Union, signalling the need for change across value chains. New policy initiatives are being spearheaded by a number of CSOs forming coalitions, these developments could shift the industry as it moves us toward accountability.

FTAO led Unfair Trading Practices Directive:

Power imbalances in the garment industry often nurture Unfair Trading Practices (UTPs) among retailers and brands. Given the highly competitive nature of the sector, and the profitable nature of UTPs, retailers’ practices will not improve with voluntary commitments. The EU’s adoption of a legislative approach is therefore critical if we are to set a level playing field in the sector and protect the marginalised actors of the supply chain, both in the EU and abroad.

Spotlight Initiatives

The Common Framework for Responsible Purchasing Practices (CFRPP) and the Learning and Implementation Community (LIC)

The most notable example of collaboration for alignment is the creation of the CFRPP. The framework provides a common language and alignment on what constitutes responsible purchasing practices. In turn, the LIC applies the framework for facilitating companies wanting to take new steps towards progress in their purchasing practices, develop solutions and share learning with peers, experts and supply chain partners.

The Sustainable Terms of Trade Initiative (STTI) White Paper on Commercial Compliance

STTI is a manufacturer driven initiative focused on creating fairer purchasing practices in the textile and garment industry. Led by the STAR Network, the International Apparel Federation, Better Buying Institute and supported by GIZ FABRIC, STTI has published a White Paper detailing central principles manufacturers want buyers to comply with.

Our Partner

Better Buying™ is an online rating system created to highlight areas for improved purchasing practises. Better Buying™’s overarching goal is to support the industry-wide transformation of buyer’s purchasing practises so that business relationships support buyers and suppliers in achieving their social, financial and environmental sustainability goals.

Questions?

-

The BBPI is a short, accessible survey for manufacturers to answer about their relationships with their brand partners. It contains just 15 questions and requires only 5 - 10 minutes to complete for each of their brand partners. All entries will contribute to a final score for the sector, as well as brand specific-results that can be accessed through subscription. The larger score for the sector will be used by TIWW to act as an annual “temperature check” on purchasing practices in the garment and footwear industry.

For brands, this information will provide direct feedback from your suppliers on purchasing practices. This is valuable information that can be used to build better relationships with suppliers, understand how/what processes need to improve internally and provide a basis for work on social and environmental sustainability.

Suppliers’ feedback will be shared anonymously and will help provide the industry with an idea of the current state of purchasing practices worldwide.

-

The PPA for suppliers is part of ACT’s Purchasing Practices Self-Assessment programme. The PPA seeks to reveal whether the self assessments by ACT member brands match the experiences of their suppliers. The BBPI aims to collect an industry wide data set to gather a general score of the experiences of manufacturers in the sector on purchasing practices. As such, participation in the survey is open to all suppliers, and not exclusively to suppliers of brands participating in particular initiatives/MSIs.

-

The CFRPP is a reference point and aims to set the standard for responsible purchasing practices in the garment industry. TIWW seeks to show an annual temperature check of the industry, including purchasing practices. The metric for TIWW purchasing practices is powered by the data from the BBPI survey.

The framework and the initiative are interrelated, complementary, yet, also distinct in their approach and aim. The BBPI’s questions cover all of the topics in the CFRPP on a general level. However, its goal is to collect reflections of suppliers' subjective experience on the impact of brand partners' purchasing practices on their operations. As such, the survey is not a checklist to gather feedback on your performance on each of the principles and the more detailed groundwork and progress practices of the CFRPP. The survey also goes further in posing questions related to brand behaviour on monitoring and remediating worker complaints.

For brands seeking to integrate the CFRPP into their systems and purchasing practices, it is encouraged to engage with TIWW’s metric on purchasing practices, and also consider participating in the more comprehensive Better Buying Purchasing Practices Index™ (BBPPI) to obtain supplier feedback on their practices. Supplier feedback is a crucial element in evaluating and improving purchasing practices. However, evaluation of a brands’ purchasing practices should not be limited only to supplier feedback.