Millennials are Caught in the Two Recession Trap: Millennials Continue to be Punished by the Great Recession and now the Great Pandemic.

- 1 Comment

Covid-19 continues to unleash economic havoc across the world. The financial destruction being caused by the pandemic is shattering already fragile household budgets. In the deep levels of this fog, Millennials continue to face extra layers of pressure from this crisis. This has come in the form of massive levels of student debt, a higher proportion of gig work and retail work, and ultimately no financial cushion of wealth. While some older generations have made it a sport to bash Millennials, they forget that many decades ago a one-income household was enough to purchase a home or that you could work a blue collar job and support a family. Today, blue collar work might keep the lights on but forget about buying a home in most large cities in the U.S. You also have the added layer of the cost of college. A generation ago, you could work summer jobs on a paper route and pay your way to school. Good luck doing that today when some colleges charge $60,000 a year just for a 4-year degree. Many Millennials are being caught in a two-recession trap.

The economy has not recovered

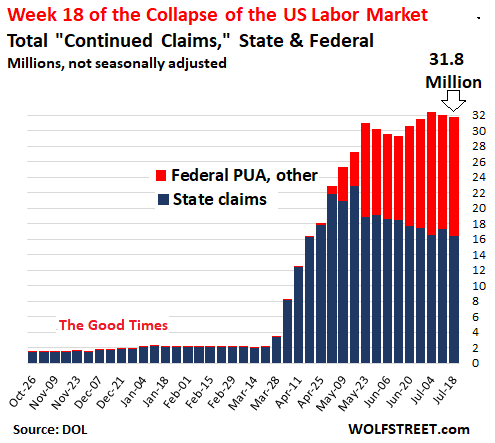

First, the economy has not recovered and we are still at high levels of unemployment. Take a look at the latest figures:

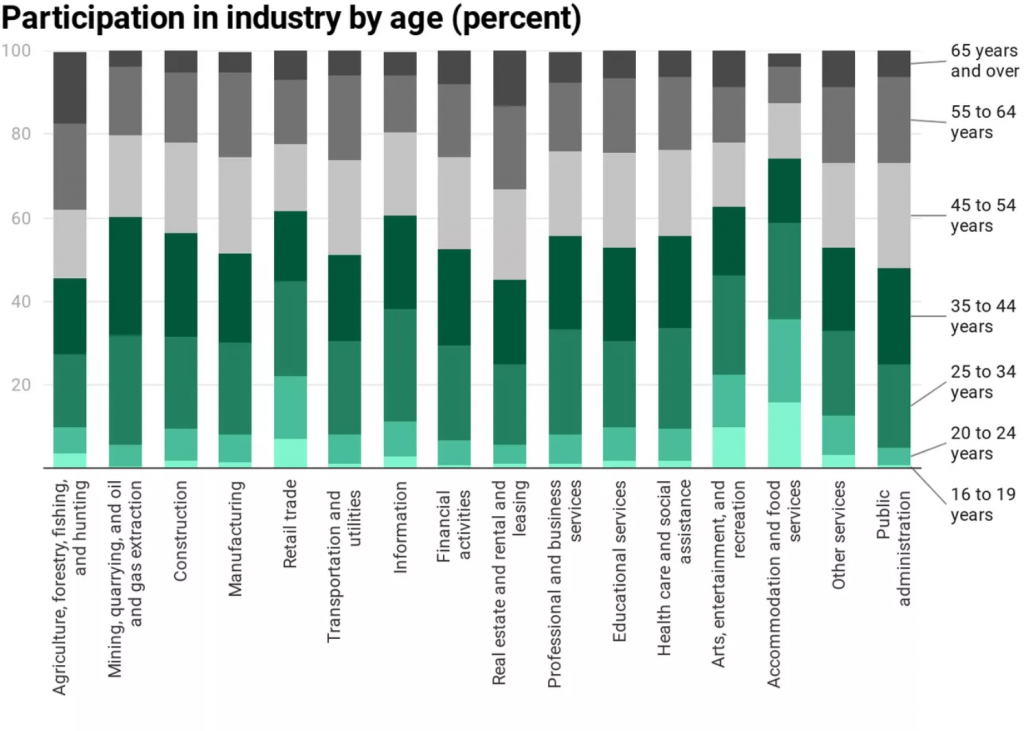

31.8 million people continue to collect unemployment benefits. That is an astronomically large number. But when you look at what jobs are being impacted the most, those in retail, food services, and gig work much of this is done by younger workers:

Retail trade and accommodation and food services are heavily filled with younger workers. These industries require face-to-face interaction for the most part and do not provide a good venue for working from home arrangements – which a large number of white-collar jobs allow (and most require a college degree – see student debt above for this Catch 22). So a vicious cycle emerges here. In order to break into the corporate world, you need a college degree. But not any degree, a degree in a highly sought-after field from a good school (keep in mind there are over 4,000 colleges and universities in the U.S. and many are not worth the money they charge). A 17 or 18 year old has a hard time deciphering the long-term ROI on a college degree but many colleges are happy to stick a person like this into a $60,000 a year degree for general education undergraduate courses. And many this year will not get the in-person experience in the fall.

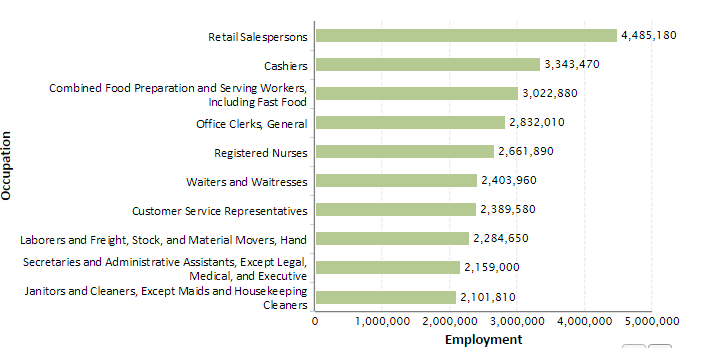

Going back to the impacted fields, these also employ the highest number of Americans:

Therefore the unemployment figures are off the charts if we really measure them correctly. The unemployment insurance claims paint a very grim picture. Many Millennials graduated college into the Great Recession of 2007 to 2009 and never really recovered since then. This “booming†economy recently was largely driven by inflated asset values (Millennials own relatively little stock and real estate which are the top drivers of wealth) so missed out on this latest bull run. Even now, the stock market is doing relatively well given the reality that we are in a deep depression and the economy is operating on crutches. But hey, you can drive a fancy Tesla (bought with debt), order a box of toys from Amazon (on a credit card), and do it all from your iPhone (financed by your cell provider). There is nothing wrong with these companies or their products but they do not represent the majority of the economy.

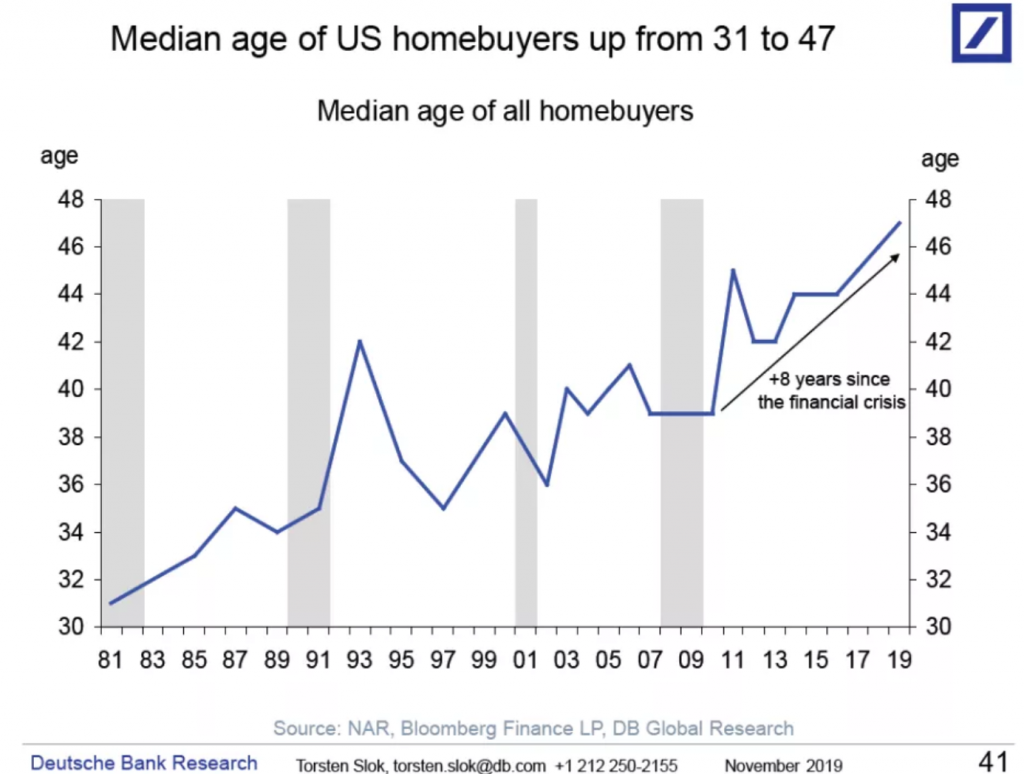

And speaking of wealth building, the biggest asset to build wealth for American families is housing. And Millennials keep falling further behind on this one:

In 1981, the median age of a home buyer was 31. Today it is 47. People usually bought homes when they felt ready to settle down and start a family. Today, many simply do not have that security (see previous jobs of younger Americans) and yet somehow older generations berate Millennials. The irony is many go off on Millennials via digital platforms run and operated by Millennials.

Why is this important?

This pandemic is hitting people hard across all age ranges, but younger people are facing a much tougher economic situation. Recessions are wealth destroyers and Millennials are now living through two of the worst recessions in the last 100 years. And as America gets older and many will rely on Social Security and Medicare, older generations should be working hard to ensure there is a good economy for young workers so they can pay taxes to support the needs that are coming downstream. Given how poorly we prepared for this pandemic with fair warning, we need to get on the same page and start planning now for this next phase.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

BG said:

Thank you– this article could not be more timely. Few Americans understand the gaping hole left by the pandemic– the economic loss of productivity continues, multiplying itself as not only lost work hours, but lost opportunity to invest and expand.

* I am already a subscriber, and very glad to have this blog on my list of regular publications.

September 18th, 2020 at 1:19 am