With unadjusted house prices recently eclipsing their 2006 housing boom peak, housing affordability is a concern in the industry and for potential home buyers. Existing home owners, by definition, can afford one so, when we are speaking about housing affordability, it is really a conversation about first-time home buyers.

“In 2017, the median renter household could afford to buy 64 percent of all the homes sold, a level of affordability only exceeded by 2012.”

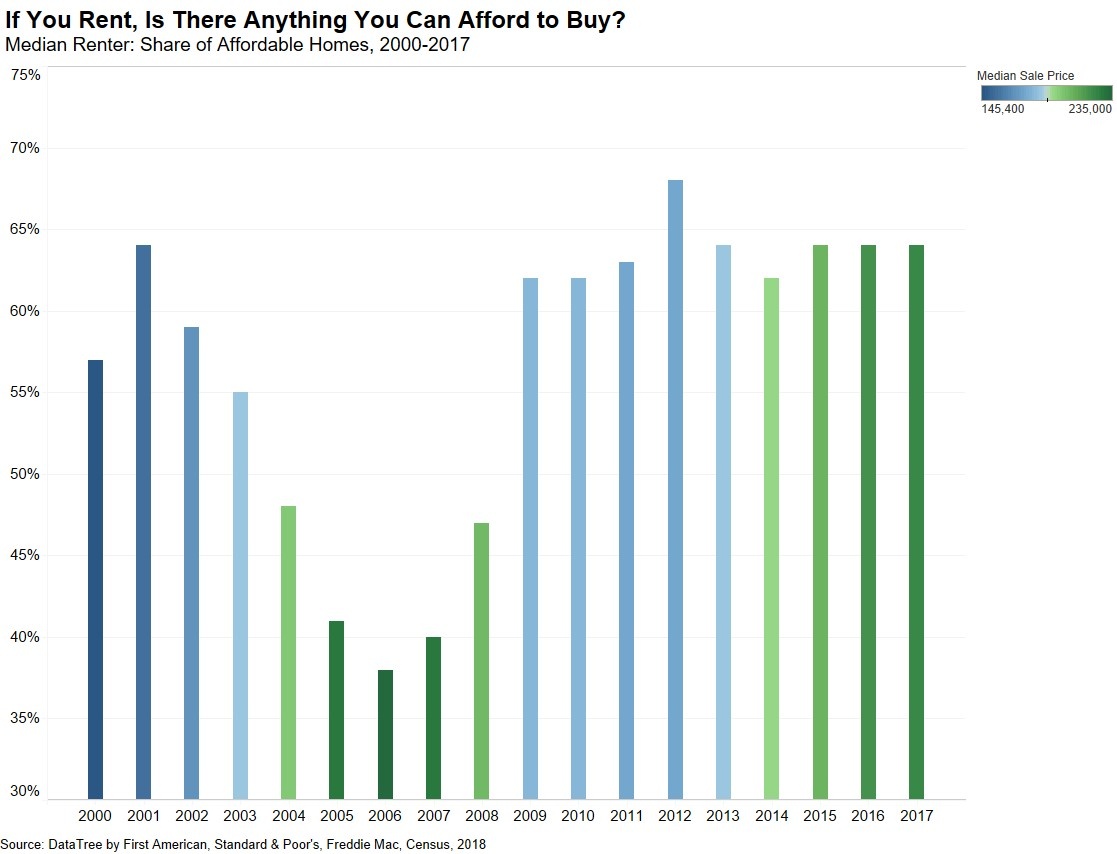

Viewing housing affordability through the eyes of people that currently rent provides fresh insights on affordability. Overall consumer house-buying power, or how much one can buy based on household income and the 30-year, fixed mortgage rate, is up 55 percent since 2006. However, looking at the percent of current homes for sale that the median renter can afford to purchase, tells a different story.

Renter House-Buying Power

A renter’s house-buying power is based on the median renter’s income, the prevailing 30-year, fixed mortgage-rate, and assumes a 5 percent down payment, and that one-third of their pre-tax income is used for the mortgage. The renter’s house-buying power can then be used to see what share of the homes for sale the renter could afford to buy. As a measure of affordability, the higher the share of homes for sale that renters can afford to buy, the more affordable the market.

Applying this approach at a national level, the median renter in 2000 had an income of $40,750, and $163,232 of house-buying power. The median renter could afford to buy 57 percent of the homes sold in 2000. However, the sharp increase in house prices fueled by demand and exuberance hit its peak in 2006, making housing less affordable for renter households. That year, the median renter could only afford 38 percent of available homes.

Peak Renter Housing Affordability

Fast forward six years to 2012 and renter house-buying power had reached $254,000. 68 percent of homes sold in 2012 were affordable to renters, the highest affordability mark in the analysis. The 2012 peak in renter affordability was driven by rising renter house-buying power combined with lower median house prices, which had fallen significantly from their peak in 2006.

Renter Housing Affordability Remains High

In 2017, the median renter household could afford to buy 64 percent of all the homes sold, a level of affordability only exceeded by 2012. Additionally, over the last three years, renter house-buying power has increased fast enough to keep pace with house price appreciation, so the share of homes that a renter can afford to buy has remained the same since 2015. Although mortgage rates are expected to rise, they are still low by historic standards, and real household incomes are the highest they have ever been. Assuming this trend continues, our measure of affordability, which takes into account income, interest rates, and house prices, indicates that homeownership is still within reach for renters.

While the trend nationally over time is interesting, real estate is local. Analyzing housing affordability for renters in specific markets can also prove valuable. Our next post will focus on the top 50 metros for renter housing affordability in the United States.

Odeta Kushi and Katherine Hayden contributed to this post.